oregon 529 tax deduction 2019 deadline

The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. Families can deduct up to 4865 worth of these contributions from their state tax.

Taxes Faqs Oregon College Savings Plan

While filing and paying taxes can be painful governments offer several deductions.

. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income. Go to Oregon 529 Tax Deduction website using the. What Families Need to Know April is generally tax season.

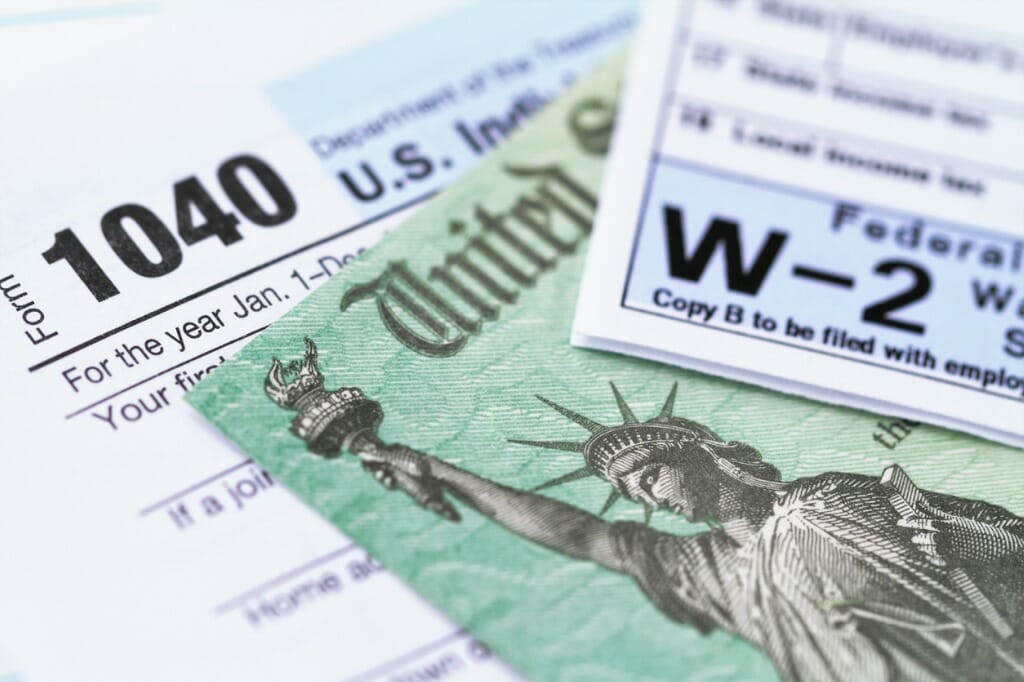

State income tax deadlines are approaching but families saving for college may still have time to reduce their 2021 taxable income. If you currently take advantage of this option you are able to carry forward. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program.

Currently over 30 states including the. Tax deduction procedures for 529 tactics. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not submit.

Rollover contributions up to. Oregon 529 tax deduction 2020 deadline. State tax benefit.

If you currently take advantage of this option you are able to carry forward. If you are an Oregon resident you may continue to subtract federally taxable military pay from your Oregon income if you earned it outside Oregon from August 1 1990. It may be limited further.

Tax Deduction Rules for 529 Plans. 100 units will always equal one year of tuition. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. At the end of 2019 I contributed 24325 to carry forward state tax deductions of 4865 over the next 4. April is generally tax season although COVID-19 has pushed back the 2020 filing deadline to July.

Oregon 529 tax deduction 2019 deadline Friday October 14 2022 Oregon 529 tax deduction 2020 deadline.

529 Plan Advertisements And Marketing Collateral

Oregon 529 College Savings Plan The Oregon College Savings Plan

General Faqs Oregon College Savings Plan

So You Re Going To Miss The Tax Filing Deadline Now What Thestreet

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Information On 529 Plans Turbotax Tax Tips Videos

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Deadline Extension What Is And Isn T Extended Smartasset

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Oregon Kicker Rebate Of 1 4 Billion Tax Revenues Up 1 Billion In Stunning Forecast Oregonlive Com

Deadlines 529 College Savings Plan Distributions Kiplinger

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Oregon State Tax Software Preparation And E File On Freetaxusa

Retroactive Tax Benefits With April Deadlines Savingforcollege Com

Who Can Participate Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

529 Plans Which States Reward College Savers Adviser Investments